DMV Point Changes and Insurance Impact

December 9, 2025

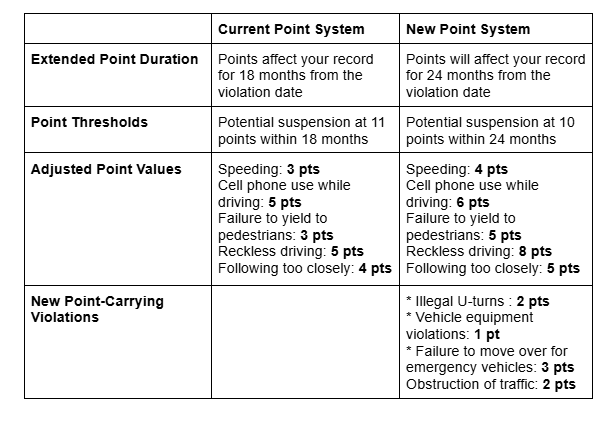

As we quickly approach 2026, there are changes coming our way for the New York State DMV point system that will impact many drivers across the state.

The New York State DMV uses the Driver Violation Point System to identify and take action against high-risk drivers. Points are added to your driving record for certain types of violations such as speeding, reckless driving, improper cell phone use, failure to signal and much more. The severity of the violation impacts the number of points per incident that are added to your record. There are some violations such as pedestrian and bicycle violations, parking violations, unregistered, unlicensed or uninsured operations that do not result in points.

Key Changes Coming in 2026

All drivers should understand the revisions of the NYS DMV’s point system which is scheduled to take effect in January 2026.

Why Is NYS Administering These Changes?

There are several intentions the state has for implementing these changes including addressing modern driving issues such as distracted drivers and the use of smart phones, improving overall road safety, reducing traffic-related deaths, and aligning with surrounding states.

How Do Points Impact Insurance?

Insurance companies have their own system to determine how an individual’s driving record will impact their premium and coverage eligibility. With more points from a broader range of violations comes a higher risk of policy cancellation problems as well as higher rates. Keep in mind taking a DMV-approved Point and Insurance Reduction Program will help reduce points on your license as well as save 10% on your liability and collision insurance premiums.

The upcoming changes aim to target dangerous driving more efficiently, but it will also create a greater cost for drivers who experience a seemingly minor violation which overtime can quickly add up to a major financial and licensing issue.